We are distinctly pleased to have the opportunity to interview Mr. Roberto Re, the CEO of Metinvest Trametal and Ferriera Valsider, the Italian production units within the Metinvest Group. As established players in the steel industry, these companies have a significant impact on market trends, technological advancements, and sustainability initiatives. This interview aims to delve into the strategic insights, operational challenges, and future prospects of Metinvest Trametal and Ferriera Valsider under Mr. Re’s leadership. We look forward to exploring his perspectives on the industry, the innovations shaping the future of steel manufacturing, and the pivotal role of these companies in the global market.

Can you provide a brief overview of Metinvest Trametal and Ferriera Valsider, highlighting their roles within the Metinvest Group?

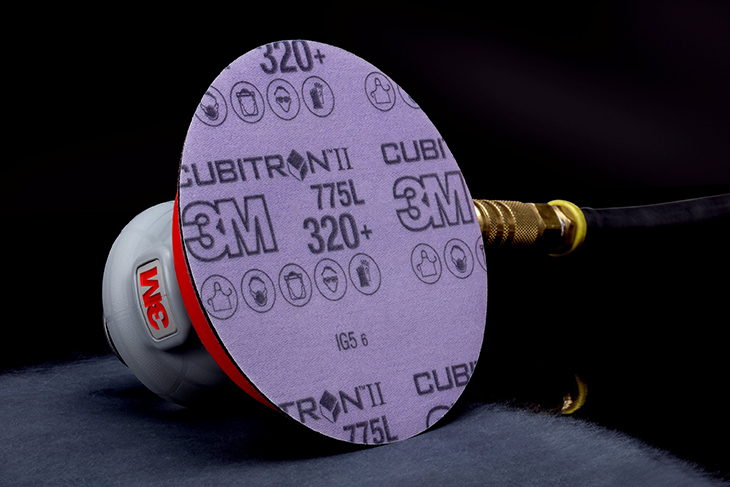

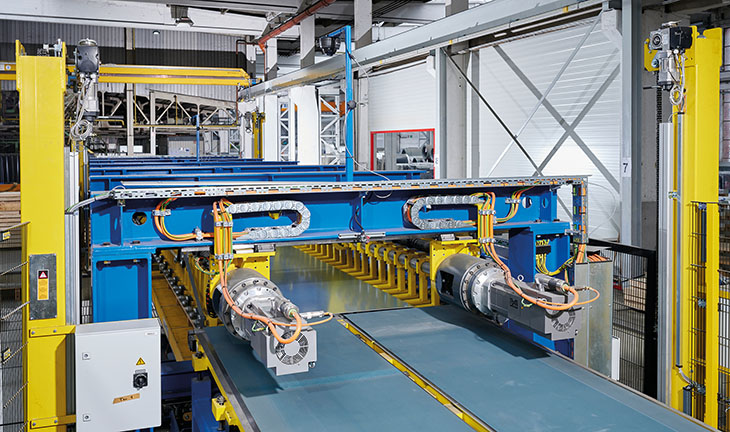

Metinvest, the largest metals and mining group in Ukraine, encompasses several iron ore and coking coal mines, steel mills, and steel re-rolling plants in Ukraine, the EU, and the USA In 2021, Metinvest produced approximately 45 million tonnes of iron ore (ranking among the top 10 global producers) and over 13 million tonnes of steel (within the global top 45). The group was heavily impacted by the Russian invasion of Ukraine, with significant damage to core steelmaking assets in Mariupol. The Russian blockades of Ukrainian sea ports and disrupted logistics have also significantly reduced iron ore production by the group. In 2022, iron ore production fell to less than 15 million tonnes, steel production to less than 5 million tonnes. Even under incredibly difficult war conditions, the company has managed to maintain operations, support its employees and the people of Ukraine, and continue developing its business strategically. Metinvest Trametal, located in San Giorgio di Nogaro, in the East of Italy, is one of the most advanced steel plate producers in Europe. The company was founded in 1985 and acquired by Metinvest Group in 2008. Trametal produces around 500 thousand tonnes of quarto plate per year, around 5% of the total plate production in Europe. Trametal was established as a state-of-the-art production facility with a rich product range suitable for all major consumption sectors. It has become a key player in Southern Europe, successfully competing in certain market niches with established European giants that have been in the market for centuries. Founded in 2001 in Vallese di Oppeano (Verona), Ferriera Valsider started as a producer of hot-rolled coils from slabs, with subsequent development and expansion into double production capability, including plate. Current production output of Ferriera Valsider is around 300 thousand tonnes of plate, as we prioritize plate production over HRC. Trametal and Valsider transform (re-roll) semi-finished steel (slabs) into steel plates according to the requirements of various end-use projects, including bridges, large structures, ships, specialized machinery, vessels for liquids and gases, among others. We serve over 1000 industrial customers, with our core sales markets being Italy and Germany, the two main steel consumption regions in Europe. Resilience, quality, competence, and reputation have enabled the widespread use of Trametal and Valsider products by leading steel processors in Italy and Europe. Notable projects using our steel include the new highway bridge of Genoa (Ponte San Giorgio), completed in 2020 primarily using Trametal plates for the main structure, the Hudson Yard center in New York, and the new sarcophagus of Chernobyl in Ukraine. Considering our leading positions in shipbuilding sector, many of cruise liners currently roaming around Europe have been produced with our steel. Trametal and Ferriera Valsider together employ around 500 people in Italy.

What have been some of the pivotal moments in the history of Metinvest Trametal and Ferriera Valsider that have shaped their current positions in the market?

Trametal, initially established as an independent plate re-roller, was acquired by Metinvest in 2008. This has profoundly changed the business model of the mill, as slab purchasing has moved from open market to integrated intra-group sourcing. This allowed for a maximum level of quality control, delivery reliability and product mix. Valsider was initially integrated into the Metinvest group’s supply chain. Over the years, the integrated business model has allowed Trametal and Valsider to become reliable suppliers for European customers in terms of availability, quality and competitive pricing. Disruptions started in 2014 with first local invasion of Russia in Donbas region of Ukraine, Covid crisis followed in 2020 and forced us to stop production for several weeks as required by the state. Critical change of situation in 2022, with a full-scale Russian invasion, destruction and occupation of Mariupol and massive damage to Metinvest steel mills, Azovstal and Ilyich. Change of business model from integrated steel re-rolling to stand-alone re-rolling with independent slab purchasing. Invaluable support of Metinvest Group, competences and market position of the company allowed for continuous business in Italy, despite radical disruption of 2022.

How do Metinvest Trametal and Ferriera Valsider fit into the European steel market? Are there specific sectors or regions where these companies play a crucial role?

FV was mostly oriented on HRC production in the last 10 years. The mill produced around 500 kt of coils annually, roughly 6% of HRC consumption in Italy (excluding material for re-rolling). In 2023, we’ve increased a share of plate in production due to better profitability of the product compared to HRC. Together Trametal and Valsider had around 6-8% of market share in the European plate market, with focus on the largest markets of plate consumption in Italy and Germany. We have a rich diversified customer base, representing all main market segments, steel distribution, construction fabrication, shipbuilding, manufacturing of machinery and energy equipment. Many of our customer are long-term partners with which we have developed many important projects. Competitive advantage of Trametal and Valsider was for years based on two pillars, high quality product mix with specialized “niche” products such as shipbuilding plate, high-strength material for complex construction projects, and high flexibility of deliveries due to re-rolling model. This combination allowed us to serve even the most demanding customers and establish regular long-term supply agreements.

How do Metinvest Trametal and Ferriera Valsider manage their supply chains? Are there any notable partnerships or collaborations that have significantly impacted the companies? Complete change of business model after the Russian invasion in Ukraine?

Before the beginning of the full-scale war in Ukraine, our supply chain, with its core task of feeding production with slabs, was fully integrated with our production sites in Mariupol. Our mills in Italy and the UK were receiving and processing 1,5 million tonnes of slabs from the mother company, with shipments organized on regular weekly basis utilizing reliable shipping routes from Mariupol and Black Sea. We had also created and developed a network of strategic partners in Italy, allowing us to manage port operations and logistics. Instead, the severance of the supply from Ukraine meant for the company a complete rethinking and restructuring of slab procurement and deliveries. This was a massive challenge, and through many disruptive months we have diversified the sourcing to multiple suppliers from Europe and Asia. The change meant a need to change ports of arrival, organize offloading, storage, and deliveries of slabs. The transformation meant a significant increase of procurement and production costs for Trametal and Valsider, which we had to bear to maintain the business and ensure the fulfilment of our customers’ needs. This enormous challenge was faced while many of our competitors in Europe continue to use Russian slabs, which are still admitted in the EU at prices significantly below all other sources (around €100/t below other sources in 2022-2023). While the EU has banned imports of Russian finished steel, slab was granted an exception from sanctions and is allowed to be imported for another five years, amounting to almost 11 million tonnes.

How do Metinvest Trametal and Ferriera Valsider approach employee development and training? What aspects of your corporate culture are you most proud of?

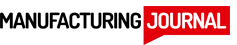

The company has a complex approach to HR management incorporating best practices in the industry. We attract younger people to the company through advanced training, participation in ongoing transformation projects and clear career paths. Sustainability of the company, especially through the turbulent transition period we live in today, is based on people. We regularly assess and identify future leaders of the company among our team, propose options for advancement through development projects. The ongoing transformation of the company on various levels, such as production upgrades, digital tools, new sustainability initiatives provide many paths for our people to grow and deliver important results.

How are global trends like digitalization, Industry 4.0, and changing market demands influencing the strategies at Metinvest Trametal and Ferriera Valsider?

In the last years we’ve made a significant progress towards complete integration of main company processes in the unified data management system. The increasing integration of data and services allows various functions to have a level of communication and cooperation not achievable previously. This is especially important when we live through complicated market periods as in the years starting from 2020. The process of digital transformation inside the company is continuous and includes practically all spheres of operational and strategic activities. Recently, we have been exploring the enormous potential presented by AI solutions on the market. The most obvious choices might include easier seamless access to complex technical information related to the world of steel. In the future, we hope to progress also with AI tools for planning and forecasting.

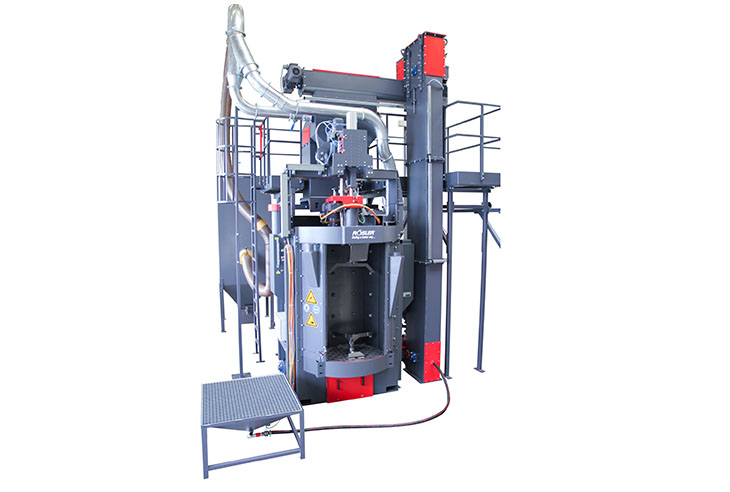

What initiatives are Metinvest Trametal and Ferriera Valsider undertaking to promote sustainability and environmental responsibility in their operations?

Metinvest Group long-term de-carbonization strategy includes updates of existing steelmaking units in Ukraine (obviously conditioned by developments in the war) and establishment of new facilities in Ukraine and Europe, which will correspond to the evolving environmental regulation in the EU. Meanwhile, Trametal and Valsider in Italy always implement more stringent production standards to navigate the future with the best possible environmental profile. In the last 2 years, both mills have issued Environmental Product Declarations, which we keep updating according to standard requirements. A big change comes with the introduction of CBAM in the EU, as all our slab supplies from Asia will be subjected to emission declarations and corresponding payments from 2026 onwards. Our ultimate goal is to ensure that our feedstocks have the lowest possible environmental impact. This goal has dual nature of ethical choice and economic logic of the business compliant with new requirements. We consider the changing environmental regulation in Europe the biggest challenge for the whole European steel industry in the coming 20-30 years. There will be radical updates of production technologies, coming at very high costs which will be shared among steel producers and public sources. Steel consumers, starting from fabricators working with big public projects and ending with small, specialized workshops, will eventually introduce new rules and requirements for purchased steel, in order to comply with the standards of the final customers. The years from now to 2050 will knock some players out of the market and will allow those capable of timely changes to evolve and prosper. We hope to be among the later with our long-term sustainability vision.

What are the future plans for growth and expansion at Metinvest Trametal and Ferriera Valsider? Are there any upcoming projects or investments that you can share?

Talking about Trametal and Ferriera Valsider, our primary objective is to guarantee consistent product quality and mix, continuous service to our customers. Ferriera Valsider, with increasing focus on production of quarto plate, needs more capabilities in processing plate, such as thermal treatment and cutting. We are mostly focused on the equipment necessary to do the job in the next 3-5 years. Metinvest Trametal, already a very advanced plate mill, constantly upgrades its equipment, quality management and service level to stay ahead of competition in terms of strategic customer contracts. Instead, on the level of Metinvest Group there are large-scale plans of expansion with new production units, with Italy the prime destination for such investments as of today. The group works together with Italian partners on potential construction of a new steel mill in Italy, but the project is still in the phase of feasibility study.

As the CEO, what is your vision for the future of Metinvest Trametal and Ferriera Valsider? How do you see the companies evolving in the next decade?

Our primary longer-term objective is to remain a supplier of choice for our customers navigating the complex period of economic disruptions over the next 5-10 years. We will continue to strive for the highest product quality and service, working at competitive low costs, gradually improving our environmental profile. Essentially, our two mills will remain the same, but, as we’ve shown in the last 20-30 years, it’s not only production configuration, but much more people’s expertise and customer-oriented mentality that can make or break a successful business. We are producers of commodity steel, but we are also providers of solutions and value drivers for our partners. We invest in people, technical capabilities and service tools and the long-term goal is to be strong, sustainable, and successful.