Bio: Emily Newton is the Editor-in-Chief of Revolutionized Magazine. She regularly covers news and trends in the construction and industrial sectors.

No industry was spared from the impact of the COVID-19 pandemic — but the construction industry was one of the hardest hit.

The pandemic had an almost-immediate effect on the industry as companies put projects on hold and businesses across the country stopped investing in new development. At the same time, necessary worksite safety restrictions slowed down work and troubled the industry, which was already contending with a tight labor market.

However, the exact impact of the pandemic varied greatly depending on variables like location or project sector.

Now, more than a year after the pandemic began, new construction projects are underway, and many projects previously on hold are returning to work. The industry as a whole is also beginning to get an understanding of how it was impacted by the pandemic — and the long-term effects that the pandemic may have.

1. Sharp Job Losses Followed By an Above-Average Recovery

Compared to the rest of the economy, the overall construction industry saw a quick rebound — according to Bureau of Labor Statistics data, the industry had recovered 61% of lost jobs by August 2020, compared to less than 50% for the overall economy.

However, despite the fast recovery, the industry isn’t close to pre-pandemic levels of activity yet.

Many businesses with pre-existing projects paused or canceled them. A recent report from the American Road & Transportation Builders Association (ARBTA) estimates that around $9.6 billion of infrastructure projects, for example, have been delayed or shelved due to the pandemic.

ARBTA has also forecasted that the U.S. transportation construction market will shrink by 5.5% in 2021. A continued slowdown in activity of major projects — including bridge and tunnel construction — may be partly responsible for this decline.

It’s unlikely that the industry will see a return to pre-pandemic levels of activity until after the pandemic winds down, likely at some point in 2021. Until then, project starts may remain low, forcing businesses to keep operating costs low to stay in business.

2. Commercial Construction Continues to Lag Behind

The quick recovery of the construction industry also wasn’t evenly distributed — some sectors have fared much better than others.

According to Ken Simonson, the chief economist with the Associated General Contractors of America, Residential construction workers are mostly back to work, with 81% of the sector’s job losses recovered by August 2020. By contrast, commercial construction saw just 46% of lost jobs recovered over the same period.

Individual municipalities are seeing similar patterns. In Pittsburgh, for example, while nonresidential construction fell by more than 76% between 2019 and 2020, residential construction in the area fell just 32%.

Simsonson believes that the difference is likely due to a combination of economic uncertainty and low revenue. Simonson notes, for example, that highway construction depends on gas and diesel taxes, which have fallen off sharply since the pandemic began.

Similarly, airline construction is mostly on hold as the industry continues to wait for air travel to return to normal levels. The same goes for the hotel and retail construction sectors, which were already struggling with below average revenues before the pandemic.

It’s hard to know if these patterns will persist after the pandemic is over. Some sectors may continue to struggle for some time. There’s also reason to expect that businesses may remain cautious after the pandemic is over, even once it seems safe to begin investing in new construction.

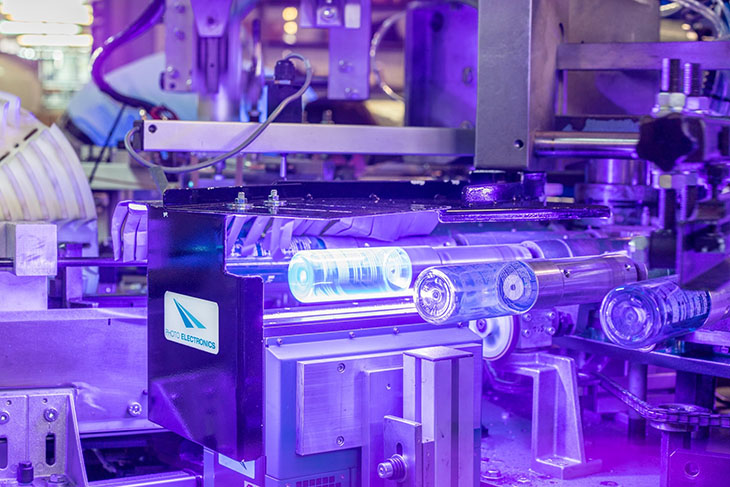

3. Digital Tools Become Even More Valuable

There’s evidence that the pandemic has pushed construction companies to adopt new digital solutions — like safety technology, teleconferencing software and building information modelling solutions — potentially accelerating the sector’s ongoing digital transformation.

During the pandemic, remote conferencing tools have helped to cut down on face-to-face interaction, potentially reducing the chance of virus spread on job sites or at meetings between project stakeholders.

Technology can also help to streamline the design and planning process — potentially bringing down project costs at a time when money is especially tight. Features like automatic clash detection, conflict checking and site forecasting tools can help project managers avoid errors and keep construction costs as low as possible.

Building information modeling tools, for example, have become increasingly valuable during the pandemic both as a design and project management tool, and as a way to collaborate with stakeholders remotely.

Digital tools like BIM software have also enabled businesses to go paperless as a way to reduce operating costs and to help ensure company-wide access to information.

At the same time, construction technology companies are adapting existing solutions to meet needs that have arisen during the pandemic. Some, for example, are using AI-powered machine vision technology that detect workers who are too close to one another and alert supervising staff.

In the future, we may see these changes linger. Businesses may continue to use videoconferencing to host shareholder meetings or employ BIM tools to share data among project managers, even once it is safe to collaborate in person.

4. COVID-Related Illness and Disability May Cast a Long Shadow

A new study tracking the results of more than 730,000 COVID-19 tests found that construction workers had the highest positivity rates for asymptomatic cases among any profession — including front-line workers like doctors, nurses, grocery store employees and teachers.

The long-term health impacts of COVID-19 aren’t clear yet, but there is growing evidence that moderate to serious infections may cause damage to the heart, kidneys and lungs.

A pre-pandemic study published in BMJ Journals found above-average disability rates in the construction industry. The spread of COVID-19 may make these issues worse.

Construction companies wanting to tackle this issue likely have options. In an email to Construction Dive, one of the study’s co-authors recommended additional testing on job sites as a possible method of managing the spread of COVID-19 among construction workers.

What The Construction Industry May Look Like Post-COVID

COVID-19’s impact on the construction industry was severe, and the recovery will likely be uneven. Both the effects of the pandemic and how the industry is responding are likely to provide insight into what the construction industry will look like in a post-COVID world.

Commercial construction work remains low, despite a strong recovery in the residential sector of the industry. These trends are likely to continue for as long as local government revenue remains low and major industries grapple with below-average demand.

At the same time, the pandemic has pushed construction companies to adopt technology like video conferencing tools and BIM software. Remote meetings and virtual collaboration may remain the norm well into the future.