Kvanted, a new Finnish early-stage venture capital firm, is announcing today the launch of its first fund of €70 million to fulfill its mission of shaping the future of industrial innovation.

HELSINKI – November 7th, 2023. Today, a new early-stage investment company Kvanted Ventures announces its first fund of €70 million. Founded by Maria Wasastjerna, Eerik Paasikivi, and Axel Ahlström, Kvanted focuses on early-stage industrial technology startups in Northern Europe, making the company the first pure-play industrial technology investor in the Nordic region. The fund will invest in around 20 companies, with initial investments ranging from €0.5 to €3 million, and a longer-than-average investment term to align with the longer development cycles in the industrial domain.

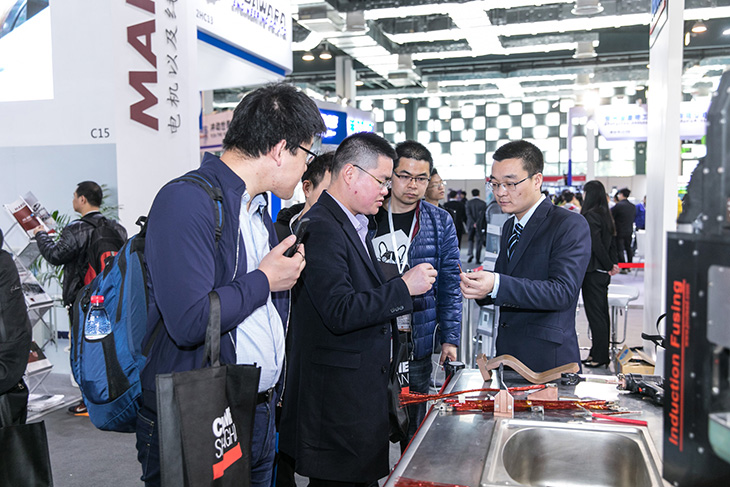

Driven by an unprecedented investment need in Europe to stay competitive and decarbonise the industrial sector, Kvanted positions itself as one of the accelerators of the next industrial revolution. With a mission of building a more sustainable and efficient industry, Kvanted connects traditional industries with innovative technology startups.

"The industrial sector is the cornerstone of the European economy. But in terms of technological development and digital transformation, there is still a lot to be done – and a lot of untapped potential. To remain competitive and to contribute to a more sustainable world, the industrial sectors in Finland, the Nordics, and beyond need to evolve. This can be done by accelerating industrial innovation with technology, which in turn requires smart capital and deep industrial expertise – and a connector that can bring traditional industrial players and innovative startups together,” says Kvanted’s founding partner Maria Wasastjerna and continues; "There has been no early-stage investor like Kvanted in the Nordic market and we are responding to this demand with an industrial technology fund. Our goal is to quickly grow into the leading early-stage investor in the Nordics for technology companies that are transforming the industrial value chain.”

Kvanted invests in both hardware and software alike, as well as service companies developing new solutions for the industrial value chain, with a strong focus on industrial automation, sustainability and supply chain resilience.

"Solving the biggest challenges of our time, such as climate change and an aging workforce, is not possible with software solutions alone. For this, we also need to develop solutions that exist in the physical world. At Kvanted, different from many other early-stage investors, we don’t shy away from hardware”, concludes Wasastjerna.

Renowned business leaders and growth entrepreneurs joining the team

Kvanted’s founding team has a strong track record in venture capital and private equity, legal and regulatory, and investment banking, bringing expertise in industrial investments, international growth, and navigating the regulatory field for their portfolio companies.Eerik Paasikivi brings over a decade of experience from early-stage investing in the industrial sector. Prior to founding Kvanted, Paasikivi led Valve Ventures and served as an early-stage investor in notable material technology companies such as Sulapac, Infinited Fiber, Woodio and Aisti among others. Maria Wasastjerna, previously a partner at the Nordic top law firm Hannes & Snellman and counsel at Nokia, has broad international experience in technology, digital markets and regulation. Axel Ahlström, with a background in consulting at Bain & Co and private equity at the renowned Altor Equity Partners’ industrial sector team, has been working with large industrial companies in a wide array of strategic topics ranging from M&A to performance improvement.

In addition to the core team, seasoned private equity and venture capital investor Heikki Westerlund acts as Kvanted’s chair of the board. Westerlund, former CEO of Nordic private asset management and investment company CapMan, brings to the team a wealth of know-how and experience from the broader investment landscape in the Nordics and beyond.

Kvanted's fund investors include prominent industrial players, including the established Finnish industrial owner Oras Invest, offering Kvanted's portfolio entrepreneurs unique access to industry networks and decades of experience in supporting industrial innovations.

Kvanted is also joined by an impressive group of Venture Partners with backgrounds in growth companies and large industries alike; Suvi Haimi, founder of biomaterial company Sulapac and board member at the Finnish Startup Community; Lars Peter Lindfors, Head of Innovation at Neste; and Kai Öistämö, CEO of Vaisala and board member at Nokia, will actively support and work with Kvanted’s portfolio companies with their knowledge, skills, and broad networks.

"Kvanted's focus and unique expertise in the industrial sector are exactly what companies focusing on industrial technology need in order to grow. I’m excited to be involved as a venture partner in supporting the journey of entrepreneurs who are transforming the foundations of the industrial sector," says Venture Partner Kai Öistämö.

Kvanted’s first portfolio companies are deeply integrated into the industrial value chain

Kvanted's first investments from the new fund are Fractory, an Estonian company improving the metalwork production chain, and Resoniks, a Dutch-Finnish company developing AI-powered acoustic analysis for metal companies.

Fractory, founded in 2017, is an automated on-demand manufacturing platform that connects engineers with production capacity. It streamlines the manufacturing procurement process, handling everything from quoting to manufacturing and delivery, while ensuring quality and timing. Customers rely on Fractory for series manufacturing, project manufacturing, and prototyping. The company aims to optimize machinery usage by distributing jobs based on manufacturer availability, lead time, expertise, and capabilities.

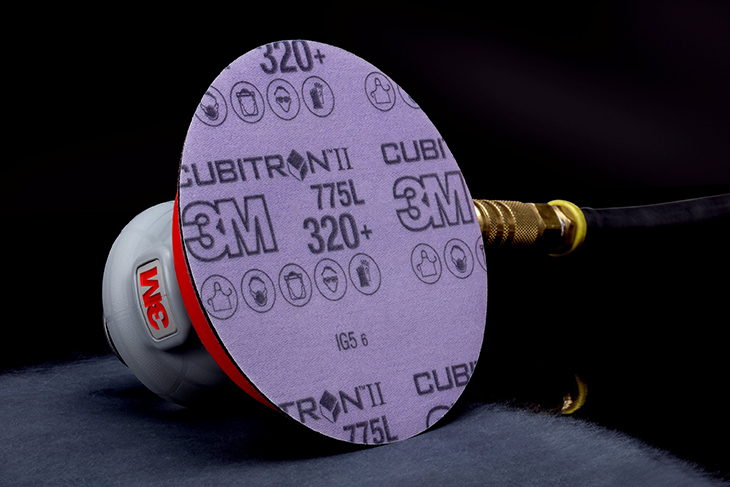

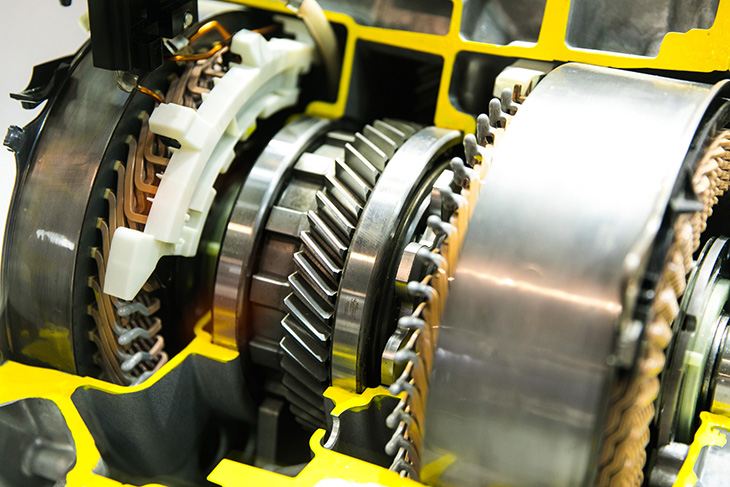

Resoniks, founded in 2022, is developing an AI-powered acoustic analysis solution for quality control. By combining acoustics and artificial intelligence, Resoniks detects anomalies in metal components by analyzing their acoustic response. This automates monotonous and potentially hazardous inspections and ensures products meet strict quality standards. With Resoniks, companies, especially in automotive and maritime, can identify defects invisible to the human or machine eye, reducing waste and energy consumption.

“Our first investments, Fractory and Resoniks, are prime examples of industrial technology companies with mission-driven teams. Both companies are reinventing processes to enhance industrial efficiency and demonstrate immense potential in improving the industrial value chain. We are thrilled to work with the best entrepreneurs from the get-go”, says Kvanted’s founding partner Axel Ahlström.

"Kvanted understands exactly what we are doing. The team's broad industry experience and unique networks provide us with exceptional access to new growth opportunities. Kvanted is the best possible strategic partnership for Fractory at this stage. With Kvanted's support, we are excited to continue helping companies in Finland and beyond grow with our solution," says Martin Vares, co-founder and CEO of Fractory.

“We're honored to have Kvanted onboard as a strategic investor, recognizing their invaluable industry expertise and envisioning a fruitful, long-term partnership”, says Felix Wassmann, co-founder and CEO of Resoniks.